Setting Up QuickBooks Properly will save you time, money, and aggravation.

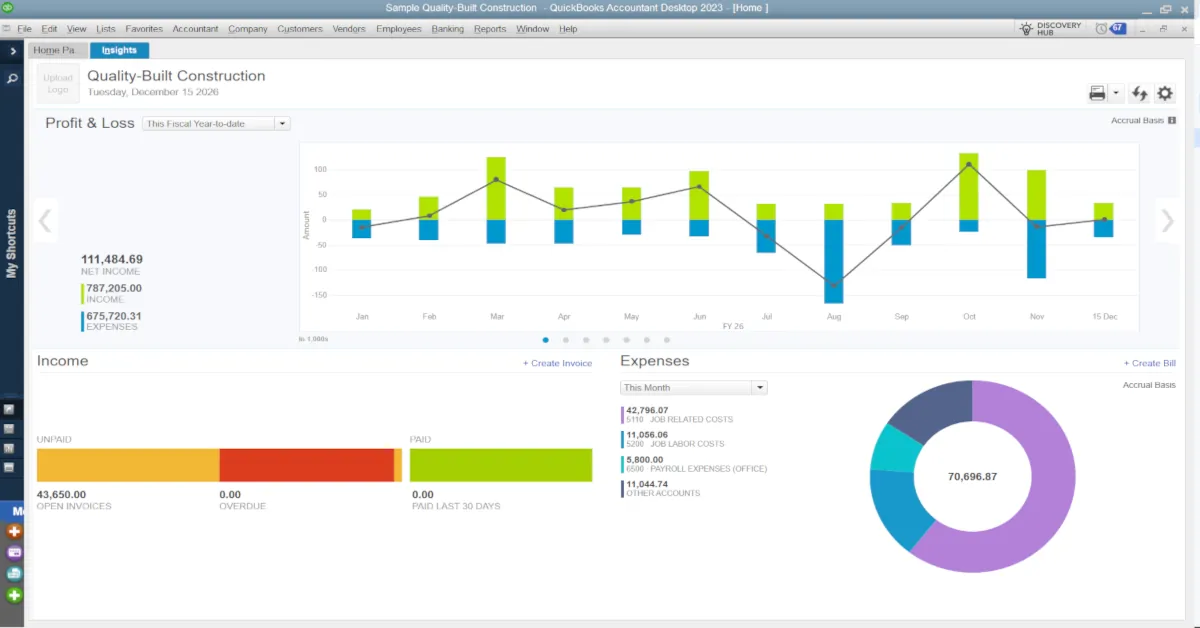

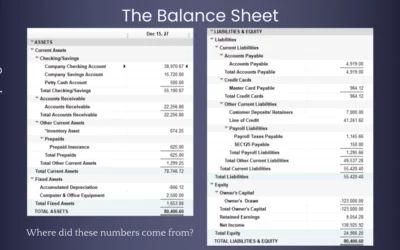

Setting up your Company File correctly, from the start, will help avoid headaches down the road. You will save yourself a lot of aggravation by getting this beginning step done right. If the accounts are set up correctly and your data entries match your vendor and customer lists, there will be a lot less frustrations. This may mean that you take the time to learn some basic accounting concepts to better understand the form-system QuickBooks uses to create and generate accounts, journals, ledgers, lists, items and the summary reports – The Balance Sheet and the Profit & Loss Statement.

Some of the common mistakes we see with the set-up and use of QuickBooks fall along these lines:

- Improper bank account connection procedures.

- Improper bank account reconciliation process.

- Misclassification of expense accounts.

- Improper use of accounts payable; enter bills vs. pay bills.

- Improper use of accounts receivable; create invoices vs. receive payments.

If you choose to use an accounting software like QuickBooks, you should learn some basic accounting skills as well as the software operating procedures. You may not need to understand all the accounting journals like the subsidiary ledgers, general ledger, general journal, and so on, but understanding how to create invoices, enter bills, write checks, and add to the lists in QuickBooks will go a long way to alleviate mistakes, out-of-balance accounts, and other irritations that will waste your valuable time.

Here are some resources on multiple QuickBooks setup topics:

For more information or to answer small business accounting questions, please give Manuel or Charles a call at C&M Bookkeeping, LLC. Thanks and have a great day of success!

0 Comments