Small Business Accounting series

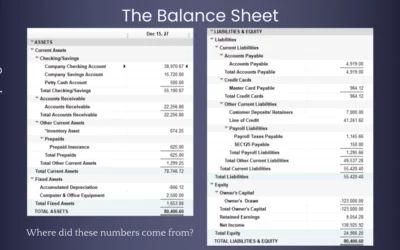

- Get your company’s Balance Sheet report for the prior year and current year. Do the same for your Income Statement. Or, alternatively, you could compare recent quarters. The main point is to get at least two time periods to compare. Export these from QuickBooks into Excel for creating an easy to set up a comparison (or, ask your accountant for these comparisons).

- Note the increase or decrease in Cash and Cash Equivalents. What is the percentage increase or decrease year over year? Note the increase or decrease in revenue year over year. What percentage gain or loss?

- Investigate what is going right for your company’s financial health year over year, or, investigate what needs to be changed or improved year over year.

This fictional company might have a problem. We would need to look deeper into the rest of the Balance Sheets and the Income Statements to get a better picture of why the checking account is 50% smaller in 2022 than in 2021. Why are they not collecting on their Accounts Receivables? What did they purchase or pay-off that used up $14,490 in savings?

By studying this Asset Section two-year comparison for this company, it shows that closer scrutiny is warranted to see if this was a

These historical financial documents show how well we have or have not done over the given period. They also provide a great managerial tool and should be leveraged by all new and seasoned small business owners. These provide the foundational information for forecasting your future revenue growth.

For more information or to answer small business accounting questions, please give Manuel or Charles a call at C&M Bookkeeping, LLC. Thanks and have a great day of success!

0 Comments