Single Vs. Double Entry Bookkeeping

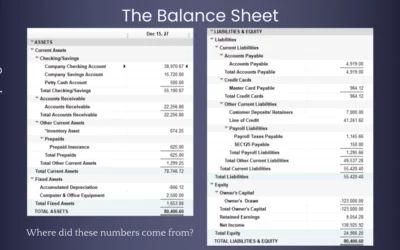

Most people have used a check register to track their checking or savings account transactions, both deposits and withdrawals. Your checking account register is the best example of a single-entry bookkeeping system. You track your deposits and the checks that you write to pay your bills in this register system. This is a time-proven, simple, and effective means to keep track of the money coming into your personal checking account and the money going out in the form of checks and other withdrawals. Double-Entry bookkeeping, on the other hand, is the most common means for businesses to keep track of their financial transactions. In this system, we set up different types of accounts in what is called the General Ledger. This is known as the final book of entry into an accounting system and is a perpetual list of all of the different classes of income and expenses, assets and liabilities, and earnings and equity that the business experiences in the course of operation. The company’s General Ledger includes the credits and debits entries of each account in dollars. A listing of the all of the accounts we set up and customize for each type of business is called the Chart of Accounts. It is a list of all of the accounts used to track a company’s transactions. The General Ledger gets its information from different journals and ledgers. We use these to add more detail to the accounting record of the business while the General Ledger shows the total dollars for a standard period of time and is usually posted monthly but sometimes more often. Where the Double-Entry comes into the picture in the accounting system is with the transactional record keeping aspects. It means that in this version, each and every transaction performed by the business will affect at least two or more accounts we list in the different journals and ledgers. For instance, if you make a deposit to the Bank Account, we will record at least one debit record to the Cash Receipts Journal, and at least one credit entry from a source, such as Sales Account recorded in the Sales Journal. When the company pays a liability, we will make an entry into the Cash Disbursement Journal with credit to the Bank Account and a debit to a liability account such as Accounts Payables. The Journals mentions are also called the Original Books of Entry and are used to track daily transactions for your business. The minimum journals required for all businesses are:

- Cash Receipt Journal

- Cash Disbursement Journal

- General Journal

These provide the totals that are entered into the General Ledger, usually monthly, and provide the details of each transaction that is not shown in the General Ledger. Even with modern software, the accounting record keeping duties still uses this method to track your business transactions. It provides much more detail than the simple check register and is the standard way of accounting around the world. If you have any questions about your company’s accounting system, please give C&M Bookkeeping, LLC a call and we will be happy to talk. You can reach us Monday through Friday, 9 AM to 5 PM or by email.

0 Comments